Participatory budget

Introducing the general budget

The general budget is the financial programme of the federal government used to achieve economic and social development. This is accomplished through the optimal distribution and efficient use of resources within the framework of the federal strategy on the expected spending by federal authorities during the coming fiscal year, provided that income and expenditure are balanced.

According to the decree of Federal Law No 8 of 2011 concerning the Rules for Preparation of the General Budget and Final Accounts, a separate budget for federal service authorities may be earmarked and submitted to Ministry of Finance (Move) for approval within budget law. Also, all federal authorities may, by virtue of a Cabinet resolution, be assigned to prepare a draft medium-term budget. The Cabinet resolution shall determine the budget's terms in years provided that it includes annual estimates for both income and expenditure as approved by the Cabinet.

Issuing the budget law

Every year during the third month of the fiscal year, Minister of Finance issues a circular containing steps for the preparation of the draft budget for the following year. The circular includes budget cap, approved strategic objectives, indicators, revenue forecast and a fixed deadline for submitting a draft budget to move.

Each federal authority determines its programmes, plans and Key Performance Indicators (KPIs) according to the strategic plan approved by the Cabinet within the budget cap. All authorities must also submit their initial forecasts for revenue and expenses allocated to chapters, line items, programmes and activities agreed upon, along with performance measures and efficiency indicators according to the circular issued by the minister, which specifies submission deadline. The fiscal year is composed of 12 months, starting from 1st January and ending on 31st December of each year.

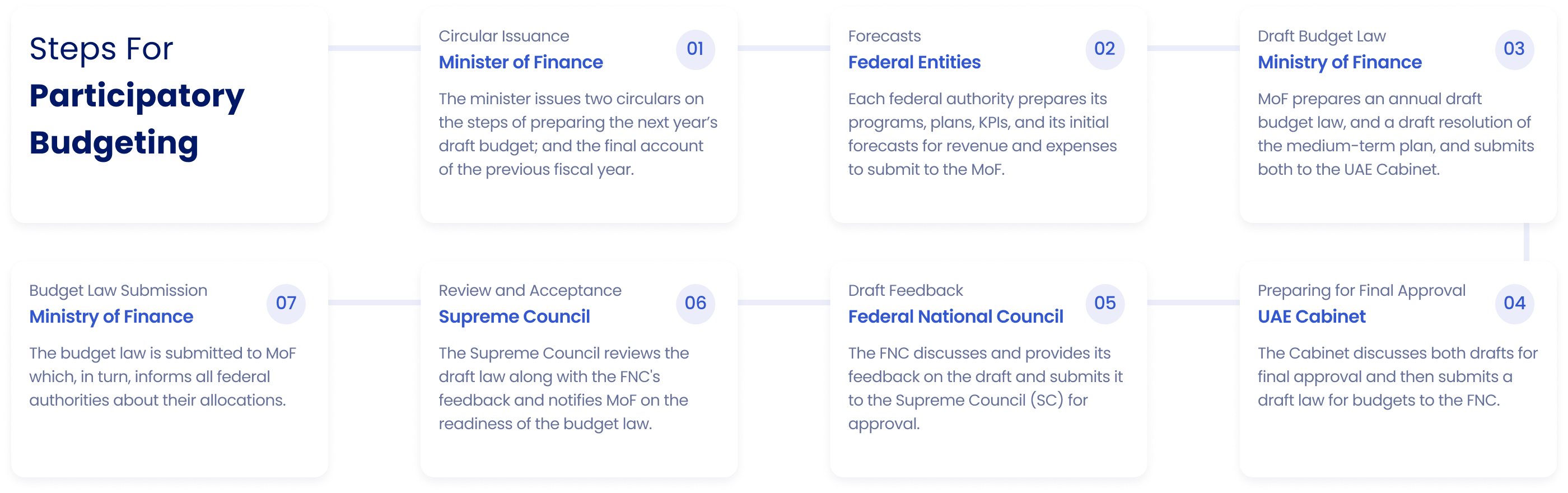

Steps for participatory budgeting

Federal budgeting process

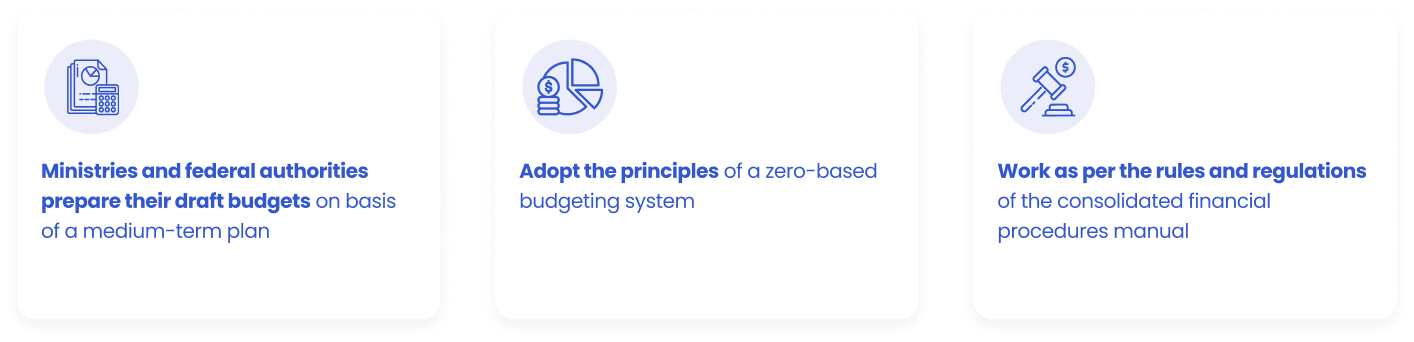

The budgeting process is initiated by releasing a financial circular on preparation of the draft budget for the following fiscal year. This financial circular is issued in accordance with the law, and based on the UAE Cabinet’s Resolution No 1/181 of 2008, which mandates all the ministries and federal authorities to do the following:

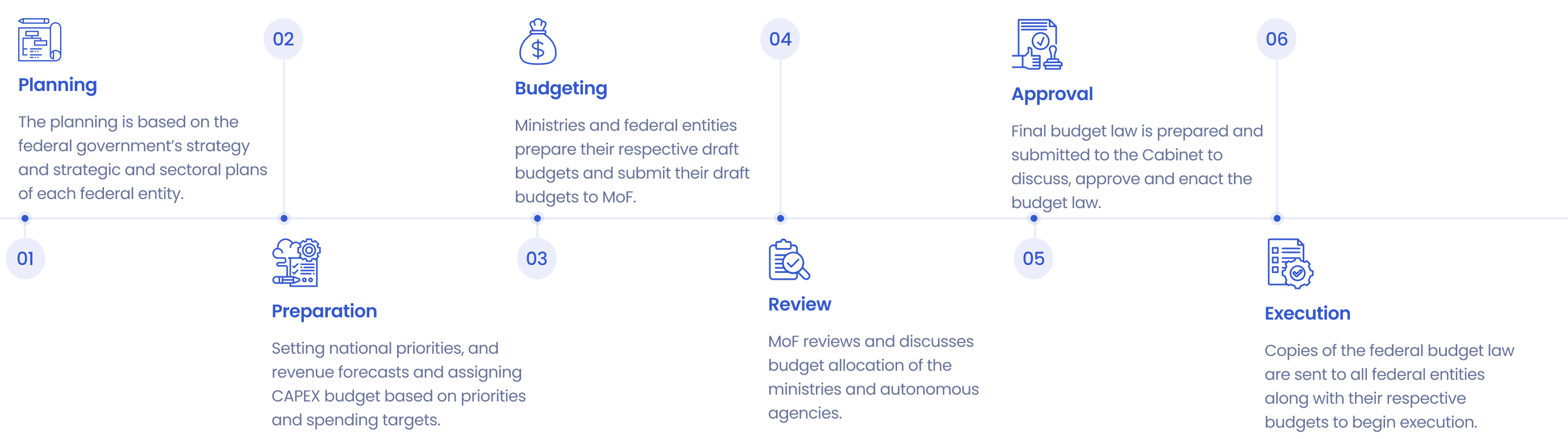

Phases of budgeting process

Budget cycle

The federal budget follows a medium-term budget cycle. The budget cycle must match the strategy cycle of the federal budget. A budget is drawn up for each year within the fiscal period, before the start of the period, and is updated annually within the budget cycle. This principle ensures that the long-term government strategy is reflected in the budget on a consistent basis. The federal budget cycle was developed from a three-year to a five-year budget cycle.

Budget development

In the last 49 years, the UAE’s budget has increased more than 291-fold from AED 200 million in 1972 to AED 58.3 billion in 2021. This has been accomplished through optimal distribution, efficient use of resources, and maintaining a balance between revenue and expenditures.

Useful links:

- Federal budgets archive - Ministry of Finance.

User cancelled the login